1732 talking about this. The properties segment which accounts for the majority of the companys sales invests in and develops residential commercial and industrial properties.

Whlen Sie aus erstklassigen Inhalten zum Thema Mah Sing Group Bhd in hchster Qualitt.

Mah sing group share. Mah Sing Group is a Malaysia-based company that is primarily engaged in three segment. 20102020 Mah Sings share price has jumped 616 from 73 sen last Thursday. Today it closed at RM124 up 295 sen or 3122 with 45962 million shares changing hands.

Fully Diluted Earnings per Share sen 1346. Mah Sings share price exceeded the consensus target price of RM1. The_JQuestion all analyst giving high hopes and confidence in mah sing once market realised it mah sing will be 1 just hold its not just glove its diversified and doing good in all of its sector takut apa meanwhile get dividend and maybe even more coming.

Mah Sing Group Berhad is a Malaysia-based company which is engaged in investment holding and the provision of management services to its subsidiary companies. Basic Earnings per Share sen 1347. 2246 Personen sprechen darber.

MAHSING is not significantly more volatile than the rest of MY stocks over the past 3 months typically moving - 6 a week. Property developer Mah Sing Group Bhds net profit rose by 40 year-on-year y-o-y to RM4028 million for the first quarter ended March 31 2021 1QFY21 from RM2871 million mainly driven by higher contribution from its property segment. Mah Sing Group Bhd.

Operates as an investment holding company. Mah Sing Group Bhd An innovative property developer in Malaysia. MAHSINGs weekly volatility 6 has been stable over the past year.

19102020 Mah Sings share price soared about 30 in two consecutive trading days on high trading volume. The group is valued at RM3 billion at todays closing price. The Properties segment invests and develops residential commercial and industrial properties.

Net Assets per Share RM 136. Stock analysis for Mah Sing Group Bhd MSGBBursa Malays including stock price stock chart company news key statistics fundamentals and company profile. Incorporated in 1991 Mah Sing Group is Malaysias leading property developer at the forefront of building quality homes and prime commercial projects in str.

With roots in trading we ventured into property development in 1994 and have risen through the ranks of prominent property developers in Malaysia. Properties plastics and investment holding and others. Gefllt 280091 Mal.

The firm engages in the development of residential and commercial properties and provision of management services. Wiki Authority Control Authority control is a method of creating and maintaining index terms for bibliographical material in a library catalogue. Mah Sing Group Company.

MAH SING GROUP BHD房地产开发部门本季度收入和利润下降这主要是由于农历新年喜庆期间传统上需求疲软以及行动控制令MCO导致的建设进度推迟 截至2020年3月31日的第一季该集团的税前盈利为4310万令吉而营业额为3亿7110万令吉而一年前的税前盈利为7390万令吉营业额则为4503亿令吉. 31052021 KUALA LUMPUR May 31. Dividend Payout Ratio 43.

1294 talking about this. - You able Purchase Mah Sing Property with some discount. The plastics segment manufactures assembles and trades various plastic.

Tan Sri Dato Sri Leong Hoy Kum CEO of Mah Sing Group. Finden Sie perfekte Stock-Fotos zum Thema Mah Sing Group Bhd sowie redaktionelle Newsbilder von Getty Images. The links produced by the authority control template on Wikipedia go to authority control data in worldwide library.

It operates through the following segments. Mah Sing Group - YouTube. Its market capitalization also rose to RM287 billion today from RM178 billion last Thursday.

10072021 Latest Share Price and Events. Innovation lies at the heart of our daily endeavors as we live our mission to be a sustainable property developer company in Malaysia. Properties Plastics and Investment Holding and Others.

Involve Developers When Formulating New Housing Policies Says Mah Sing Coo

Involve Developers When Formulating New Housing Policies Says Mah Sing Coo

Property Insight Mah Sing Ventures Into Rubber Glove Manufacturing

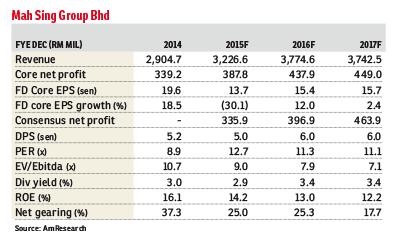

Investors Should Continue To Accumulate Mah Sing Shares The Edge Markets

Investors Should Continue To Accumulate Mah Sing Shares The Edge Markets

Mah Sing S 1q Net Profit Surges To Rm40 28m On Higher Contribution From Property Development Segment The Edge Markets

Mah Sing S 1q Net Profit Surges To Rm40 28m On Higher Contribution From Property Development Segment The Edge Markets