The Group is also involved in plastic manufacturing manufacturing and trading in Malaysia and Indonesia. Mah Sing Group 435 13mar2025 MYR issue information.

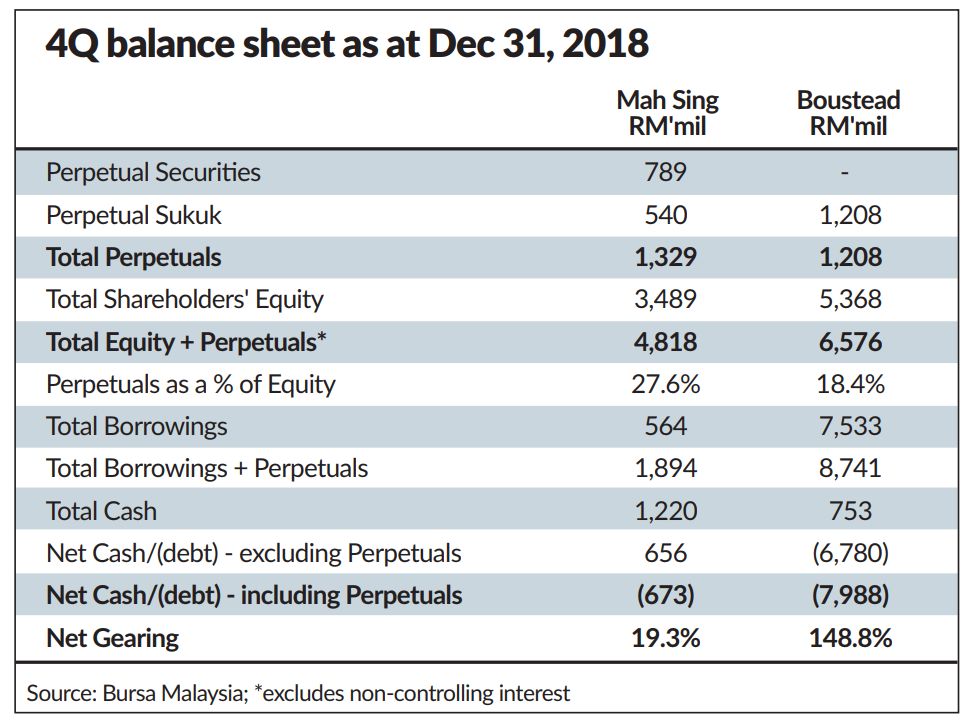

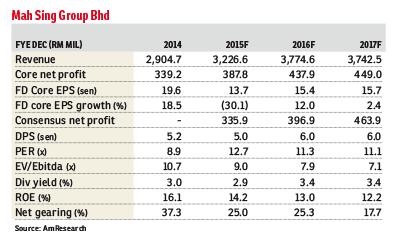

Investors Should Continue To Accumulate Mah Sing Shares The Edge Markets

Investors Should Continue To Accumulate Mah Sing Shares The Edge Markets

Mah Sing Group 655 perp MYR Anleihe Informationen.

Mah sing bond issue. Escrow Account First Issuance Opened to be opened by. Issue Information Domestic bonds Mah Sing Group 68 perp MYR. Issued on May 8 under Yinsons wholly-owned subsidiary Yinson TMC Sdn Bhd a treasury management centre set up solely to provide treasury services to Yinson and its subsidiaries the sukuk.

24122020 Mah Sing Group Berhad is a property developer. 21 Proposed Bonds Issue Mah Sing proposes to issue up to RM325 million nominal value of the Bonds at an issue price to be determined later. Large-Loan SASB.

Inventory Beta InvestorSets Deal Docs League Tables. The Bonds are convertible at the option of the Bond holders into new Mah Sing Shares at a conversion price which will be at a premium of approximately 15 to the 5-day volume weighted. Issuer Maintained operated or to be operated by.

The RM315 million nominal value of redeemable convertible secured bonds will be cancelled after the repurchase the company said in a filing with Bursa Malaysia today. Mah Sing Group Bhd has completed an issuance of secured and unrated sukuk murabahah of RM600mil in nominal value under the sukuk murabahah programme. 14032020 Mah Sing completes Islamic bonds issuance The sukuk murabahah issuance has been oversubscribed the company said in a filing with the stock exchange yesterday.

Property developer Mah Sing Group Bhd is to buy back all its unconverted secured bonds for RM3371 million. Issue Issuer Yield Prices Payments Analytical Comments Ratings. Mah Sing Group Bhd will issue up to RM1 billion worth of perpetual securities or bonds to finance the property developers land acquisitions and working capital requirement.

Loan-Level Data ABS-EE New Issue Pipeline 15G Research. KUALA LUMPUR Feb 16. View Mah Sing Group Bhds historical fixed income issuance and pricing profile here.

Issue Information Domestic bonds Mah Sing Group 435 13mar2025 MYR. Mah Sing Group Bhd is raising RM1 billion through bond issuance for landbanking and working capital amid the slowing property industry. Issuer comment quotes payment ratings.

15022016 KUALA LUMPUR Feb 15. Security Agent Signatories to the account. In June 2011 Mah Sing had issued RM325 million nominal value of the bonds.

MAH SING 6900 PERPETUAL SECURITIES - SERIES NO 1. Loan-Level Data ABS-EE New Issue Pipeline 15G Research. 07012019 A RM950 million perpetual senior sukuk mudharabah issue by Yinson Holdings Bhd made its mark in 2018 as the first perpetual sukuk by an oil and gas company in Malaysia.

KUALA LUMPUR March 6. Mah Sing Group Bhd the countrys second-largest property developer by sales value is to buy back all of its unconverted sec. MAH SING SUKUK MURABAHAH TRANCHE 1 Not Rated.

MAH SING GROUP BERHAD MYR10 billion Senior Perpetual Securities Programme applied towards payment of the relevant redemption sum. Inventory Beta InvestorSets Deal Docs League Tables. View Mah Sing Group Bhds historical fixed income issuance and pricing profile here.

MAH SING 6550 PERPETUAL SECURITIES - SERIES NO 2. Emission Emittent Rendite Kurse Preis Kuponzahlungen Analysen Ratings. Mah Sing told Bursa Malaysia today that it had entered into agreements to establish the unrated senior perpetual securities programme.

Recognised throughout Malaysia as the leading property developer Mah Sing Group Berhad brings a 20-year history and a proven track record of developing and completing prime residential and commercial projects strategically across Malaysias property hotspots. The Companys principal activity is in property development where the group develops commercial residential both high-rise and landed as well as industrial properties. Issue Issuer Yield Prices Payments Analytical Comments Ratings.

26022021 Inlndische Anleihen Mah Sing Group 435 13mar2025 MYR Anleihe-Informationen. The Bonds will be issued on a bought deal basis. Emittent Kommentar Kurse Bezahlung Ratings.

Security Agent Sources of funds.

Mah Sing S Rm600m Sukuk Oversubscribed The Edge Markets

Mah Sing S Rm600m Sukuk Oversubscribed The Edge Markets

Mah Sing Keeps Options On Plastics Spin Off Kinibiz

Mah Sing Marks 25th Anniversary With M Oscar Opening

Mah Sing Marks 25th Anniversary With M Oscar Opening

Investors Should Continue To Accumulate Mah Sing Shares The Edge Markets

Investors Should Continue To Accumulate Mah Sing Shares The Edge Markets

Mah Sing Develops Green Sanctuary For Southville City The Star

Mah Sing Develops Green Sanctuary For Southville City The Star